It's a Win-Win-Win-Win situation...

Save Money with Tax Credits

Every time we install a solar or EV charging system someone gets a tax credit. It might be a home or business owner, but most of the time GOe3 will keep the credits. This is because we often install the system at no cost to the host or property owner, paying for the system with the sale of the tax credits to others.

This works for everyone who pays taxes in the U.S. We install a lot of EV chargers with solar capabilities at no charge, we get paid by selling credits to taxpayers, taxpayers save money by buying credits at a discount from the credit value and the government accomplishes its goal of stimulating businesses that decrease our dependence on fossil fuels. If you pay taxes in the U.S., this is a way to help build GOe3 and renewable energy without having to put money at risk and wait to see what happens. (Although we’d be happy to see you do that, too). So thank you in advance for your support.

This is not about politics. The first renewable energy tax credit went into effect in 1978. There have been credits available continuously since then (except for 1 month in 1990 and 4 months in 1992). That’s 4 Democratic and 4 Republican Presidents and numerous power shifts in Congress. this could be the one thing that everyone has agreed on consistently for the last 50 years.

Tax Credits Can Stack Up

All of GOe3’s EV Chargers are designed to manage solar panels, utility demand, battery backup and can also use an EV as battery backup. Because of this, many of our projects qualify for multiple tax credits that can stack up. For example, one of our projects qualifies for these credits:

- EVSE Electric Vehicle Infrastructure Tax credit (30%) up to 30,000.00 per project location section 8911 IRS Code

- New Markets at $20,000.00 per created job created average 6 per project location not to exceed 39% of project total

- Alternative Fuel Tax Credit Form 8849 up to 30% of per project total

- Renewable Energy Solar Tax Credit ITC up to 30% of per project total

Calculating the Credits

We have a staff of specialists reviewing all the credits available for a particular project in a particular location. We use a Special Purpose/Special Allocations LLC to file these credits. This allows us to sell the credits to people who are not members of the LLC. Here’s how we prepare the credits for transfer:

- The Special Purpose/Special Allocations LLC makes the credits active

- GOe3 will determine which credits apply to each project and fill out the form 3800

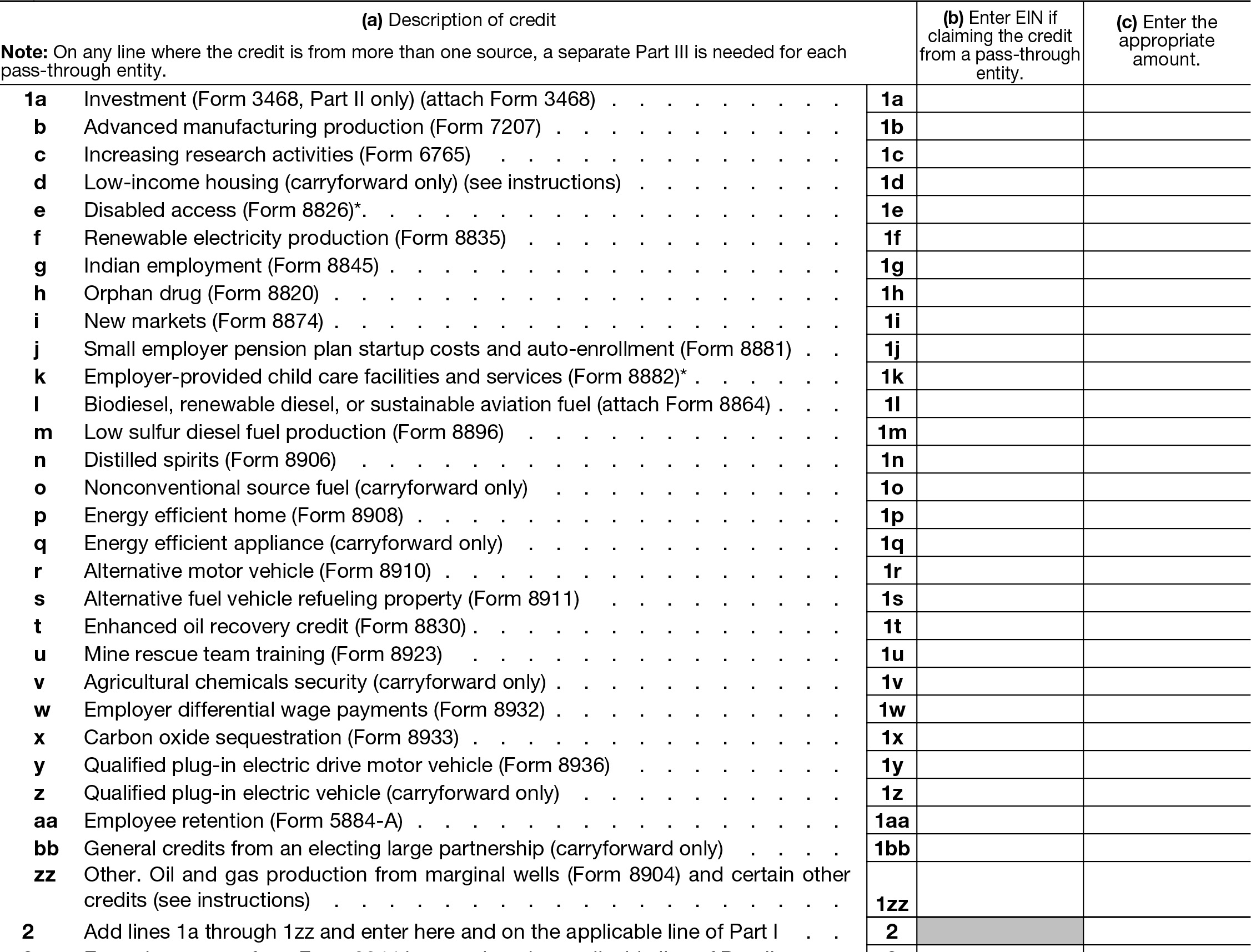

- There are 29 different categories, each with its own form as shown

- For each project, GOe3 fills out the applicable forms and enters the total on Form 3800

- Total the credits on line 2

- That amount can be divided any way desired for distribution to taxpayers

- GOe3 will fill out Schedule K-1 for each distribution to a taxpayer

- The taxpayer will pay a discounted amount for the credits

On Your Tax Return

- Enter the amount of the credit from the K-1 form on Schedule 3

- Enter the total of Schedule 3 on line 31 of your Form 1040

We’re not CPAs or tax attorneys here, just offering up a bit of direction. Consult your tax preparer for details.